How to Use the Indirect Method to Prepare a Cash Flow Statement

This is because a large business has many variable sources of income, as well as expenses. Figure 12.9 provides a summary of cash flows for operating activities, investing activities, and financing activities for Home Store, Inc., along with the resulting total decrease in cash of $98,000. By fiscal year ended June 30, 2004, Microsoft was sitting on more than $60,000,000,000 in cash and short-term investments.

Company

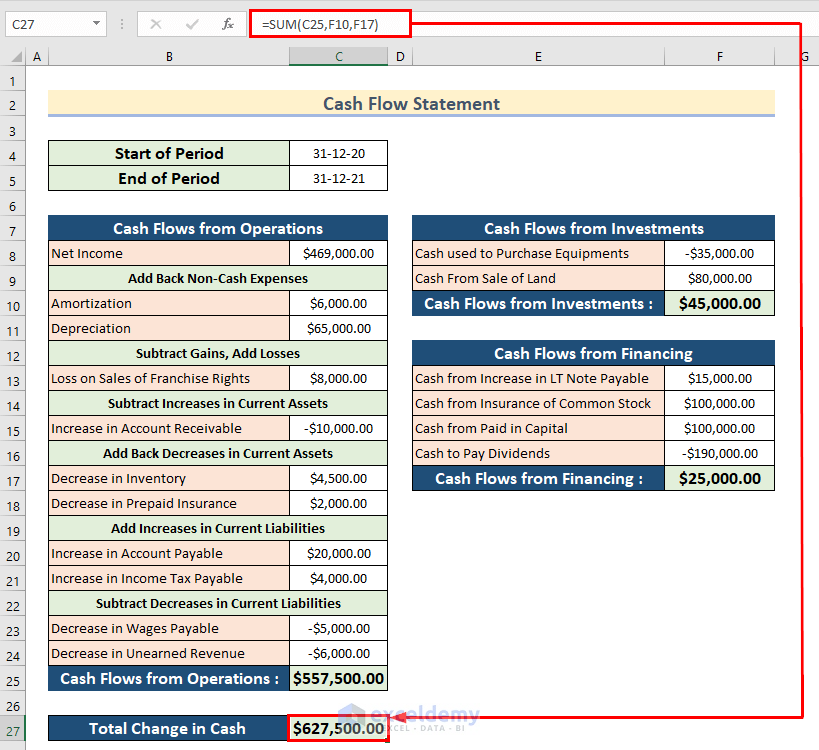

When we refer to how the “business” performs, we’re talking about this line. To find out how much is “unpaid,” we’ll need information from the balance sheet later. Cash flow from investing activities consist of proceeds from the sale of long-term (LT) assets and the purchase of new LT assets, as well as the purchase of any marketable securities such as bonds and stocks. The indirect method is one of the two treatments for creating cash flow statements.

Financing Activities Leading to an Increase in Cash

This information is important in making crucial decisions about spending, investments, and credit. The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing. The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out. Consequently, the business ended the year with a positive cash flow of $1.5 million and total cash of $9.88 million.

Related AccountingTools Courses

- If you’re doing an internal audit of your cash flows, be sure to use the indirect method.

- For example, in thePropensity Company example, there was a decrease in cash for theperiod relating to a simple purchase of new plant assets, in theamount of $40,000.

- Investing and financing transactions are critical activities of business, and they often represent significant amounts of company equity, either as sources or uses of cash.

- Cash flow statements can alternatively be prepared using the direct method, which utilizes cash accounting rather than accrual accounting.

Sam may not buy or sell stocks, but she did purchase a property and furnishings when she opened her music store last year. These purchases totaled $100,000 – which she lists as her net cash for investing activities. The steps to prepare a cash flow statement with the indirect method follow the structure of the statement. You can also see from the picture that the assets and liabilities are separated into current and long-term sections. Current assets are those that are expected to be cash or turned into cash in less than one year, whereas long-term (or “non-current”) assets carry value for more than one year, and must be depreciated.

Why do we start the calculation with Net Income?

Increases in net cash flow from financing usually arise when the company issues share of stock, bonds, or notes payable to raise capital for cash flow. Propensity Company had two examples of an increase in cash flows, one from the issuance of common stock, and one washington d c tax preparation from increased borrowing through notes payable. Add net cash from operating activities and investing activities (subtracting any negative figures), then subtract net cash used in financing activities to determine your net increase or decrease in cash (net total).

Adjustment One: Adding Back Noncash Expenses

By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via dividends or stock buybacks. The Statement of Financial Accounting Standards No. 95 encourages use of the direct method but permits use of the indirect method. Whenever given a choice between the indirect and direct methods in similar situations, accountants choose the indirect method almost exclusively.

To record this transaction, you show proceeds from the sale of the crane of $7,000 under investing activity. Assume your specialty bakery makes gourmet cupcakes and has beenoperating out of rented facilities in the past. You owned a pieceof land that you had planned to someday use to build a salesstorefront. This year your company decided to sell the land andinstead buy a building, resulting in the followingtransactions. However, it isn’t the preferred method when it comes to the standards of accounting.

To adjust, the cash flow statement reduces net income by the $500 increase in accounts receivable, displayed as “Increase in Accounts Receivable (500).” Net cash flow from operating activities is the net income of the company, adjusted to reflect the cash impact of operating activities. Positive net cash flow generally indicates adequate cash flow margins exist to provide continuity or ensure survival of the company. The magnitude of the net cash flow, if large, suggests a comfortable cash flow cushion, while a smaller net cash flow would signify an uneasy comfort cash flow zone. When a company’s net cash flow from operations reflects a substantial negative value, this indicates that the company’s operations are not supporting themselves and could be a warning sign of possible impending doom for the company.