Using the Indirect Method to Prepare a Cash Flow Statement

It’s the fastest option for most businesses, and it’s the method that accountants prefer. In the Operating Cash Flow section, all four items, Depreciation and Amortization, Share-based compensation, and other Operating Activities, instructions for form all bring in cash into the business. In the case of the Investing Cash Flow section, Capital Expenditure is a cash outflow and is deducted. However, the change in investment is positive, showing there is an increase in cash flow.

Step 2: Add Back Any Non-Cash Expenses

Positive net cash flow generally indicates adequatecash flow margins exist to provide continuity or ensure survival ofthe company. The magnitude of the net cash flow, if large, suggestsa comfortable cash flow cushion, while a smaller net cash flowwould signify an uneasy comfort cash flow zone. When a company’snet cash flow from operations reflects a substantial negativevalue, this indicates that the company’s operations are notsupporting themselves and could be a warning sign of possibleimpending doom for the company. Alternatively, a small negativecash flow from operating might serve as an early warning thatallows management to make needed corrections, to ensure that cashsources are increased to amounts in excess of cash uses, for futureperiods. Propensity Company had an increase in the current operatingliability for salaries payable, in the amount of $400.

Cash flow statements

This means her net cash used in financing activities was $95,000, as she did not begin making payments toward these loans for the first year of business. Cash flow from operations consists of cash receipts from customers and cash disbursements to suppliers, employees, and overhead expenses. Instead, we adjust net profit by adding back (or reversing the expense of) non-cash expenses, namely depreciation.

Maintains an Optimum Cash Balance

This, combined with the added complexity of the direct cash flow method is why most businesses and accountants prefer the indirect method for preparing cash flow statements. The reason why we need the indirect method is a result of the accrual basis of accounting. The cash flow statement is meant to show the cash-based transactions that occurred during the period. But, there can be some limitations given you’re reconciling the net income statement to the operating cash flows, not calculating it directly from transactions made during the period.

Adjustment One: Adding Back Noncash Expenses

- For instance, if a company issues stock options to employees as part of their compensation, the related expense is recognized in the income statement, but there is no immediate cash outflow.

- This means that the figures at the start of the cash flow statement are not cash flows at all.

- Being able to quickly determine cash flow from your other financial statements can help you stay on top of your business.

Investment activities can help any business a great deal, so having accurate cash flow records is a must. Now let’s work through each current asset and current liability line item shown in the balance sheet (Figure 12.3) and use these rules to determine how each item fits into the operating activities section as an adjustment to net income. In this case, the quarterly financials of Apple Inc. provide valuable insight into the method using which a cash flow statement of the business is calculated.

What is the Statement of Cash Flows Indirect Method?

3 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. Any portions of a balance over $100,000 will not earn interest or have a yield. Available to Lili Pro, Lili Smart, and Lili Premium account holders only; applicable monthly account fees apply. Historically financial modeling has been hard, complicated, and inaccurate. The Finmark Blog is here to educate founders on key financial metrics, startup best practices, and everything else to give you the confidence to drive your business forward.

For non-finance professionals, understanding the concepts behind a cash flow statement and other financial documents can be challenging. Solution As before, to ascertain the cash flow – in this case dividends paid – we can reconcile an opening to closing balance – in this case retained earnings. This working is in effect an extract from the statement of changes in equity. Investing net cash flow includes cash received and cash paid relating to long-term assets. Unlike the indirect method, which bases cash flow on when cash is earned (accrual accounting), the direct method bases it on when cash is received (cash accounting). Accrual accounting relies largely on payment terms to determine when cash will be earned, rather than waiting for cash to actually be deposited into a bank account.

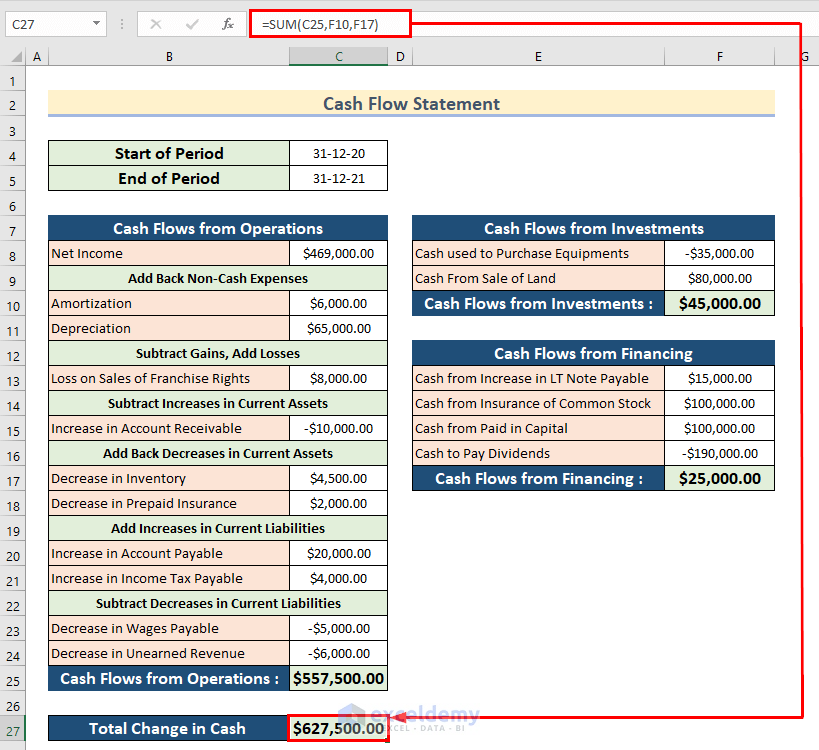

Since these expenses reduce net income but do not affect cash, they are added back to net income in the cash flow statement. This adjustment provides a clearer picture of the cash available from operating activities, excluding the non-cash impact of asset depreciation. Inboth cases, these increases in current liabilities signify cashcollections that exceed net income from related activities. Toreconcile net income to cash flow from operating activities,add increases in currentliabilities. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. The statement of cash flows is one of the components of a company’s set of financial statements, and is used to reveal the sources and uses of cash by a business.

Gains and/or losses on the disposal of long-term assets are included in the calculation of net income, but cash obtained from disposing of long-term assets is a cash flow from an investing activity. Because the disposition gain or loss is not related to normal operations, the adjustment needed to arrive at cash flow from operating activities is a reversal of any gains or losses that are included in the net income total. A gain is subtracted from net income and a loss is added to net income to reconcile to cash from operating activities. Propensity’s income statement for the year 2018 includes a gain on sale of land, in the amount of $4,800, so a reversal is accomplished by subtracting the gain from net income. On Propensity’s statement of cash flows, this amount is shown in the Cash Flows from Operating Activities section as Gain on Sale of Plant Assets.